Disclaimer: This information is for reference only and does not constitute legal advice. Please consult your attorney before relying on any legal or tax details provided.

Are Electronic Cigarette Vending Machines Legal?

Electronic cigarette vending machines are legal in many places. However, they must follow strict rules from federal, state, and local governments. These rules focus on checking ages and making sure products are accessible. Here is a clear overview of the laws for selling nicotine products through vending machines in the United States.

Federal Regulations on Electronic Cigarette Vending Machines

At the federal level, the Family Smoking Prevention and Tobacco Control Act controls electronic cigarette vending machines. They also follow rules set by the FDA (Food and Drug Administration). These rules classify e-cigarettes and similar products as tobacco products. This means they face strict measures to stop sales to minors.

Key restrictions under federal regulations include:

- Age Restrictions: Prohibits sales of tobacco und E-Zigarette products to individuals under 21.

- Location Restrictions: Prohibits the sale of nicotine-containing products via vending machines in locations accessible to persons under 21. Typically, people restrict vending machines to adult-only areas.

- Identity Verification: Retailers must verify the ID of any customer appearing under the age of 30.

Moreover, state and local regulations may impose stricter requirements than federal laws. Retailers must ensure compliance with all levels of legal oversight to remain fully compliant.

State-Specific Regulations and Licensing Requirements

Understanding state-specific regulations is essential for operating E-Zigaretten-Automaten. Below is a table summarizing key legal considerations:

| Kategorie | Einzelheiten |

|---|---|

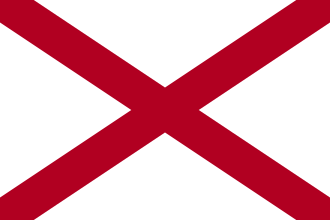

| License Requirements | Requires License: Alaska, Arkansas, California, Connecticut, Delaware, District of Columbia, Hawaii, Iowa, Kansas, Louisiana, Maryland, Minnesota, Missouri, Montana, Pennsylvania, Rhode Island, Texas, Utah, Vermont. Does Not Require License: Alabama, Arizona, Colorado, Florida, Georgia, Michigan, North Carolina, Ohio, New Jersey, etc. |

| Identity Verification | General Requirement: All states require Altersverifikation. Special Provisions: Online sales often require additional age checks; some states require signature or age declaration for mailed products (e.g., North Dakota, Tennessee). |

| Vending Machine Restrictions | Strict Restrictions: Typically allowed only in adult-only locations or under staff supervision. Special Cases: Allowed in controlled areas (e.g., South Carolina) or 21+ venues (e.g., Oregon). |

| Taxation | Varies by State: Some states tax per milliliter (e.g., California: $0.10/mL), others as a percentage of sales (e.g., Pennsylvania: 40%). |

| Other Regulations | Sample Distribution: Prohibited near schools or areas with minors. Packaging and Display: Must remain in original packaging; open display is often restricted. Underage Employee Restrictions: Some states require adult supervision for sales by minors. |

(Source: Public Health Law Center: https://www.publichealthlawcenter.org/resources/us-e-cigarette-regulations-50-state-review)

State Tax Variations and Compliance Challenges

By mid-2024, 32 states and the District of Columbia have implemented excise taxes on E-Zigarette products. These taxes vary significantly and can directly impact consumer behavior and market operations. Below are the two primary tax types:

| Staat | Vape Tax/ E-Cig Tax | Is Non-Nicotine E-Liquid Taxable? |

|---|---|---|

| Alabama | no tax | No |

| Alaska | no tax | No |

| Arizona | no tax | No |

| Arkansas | no tax | No |

| Kalifornien | 52.92% | No |

| Colorado | 56% | No |

| Connecticut | 10% | No |

| Delaware | 0.05/ml | No |

| District of Columbia | 79% | No |

| Florida | no tax | No |

| Georgien | 0.05/ml | Ja |

| Hawaii | 70% | Ja |

| Idaho | no tax | No |

| Illinois | 15% | Ja |

| Indiana | 15% | Ja |

| Iowa | no tax | No |

| Kansas | $0.05/ml | Ja |

| Kentucky | 15% | Ja |

| Louisiana | $0.15/ml | No |

| Maine | 43% | Ja |

| Maryland | 20% | Ja |

| Massachusetts | 75% | Ja |

| Michigan | no tax | No |

| Minnesota | 95% | No |

| Mississippi | no tax | No |

| Missouri | no tax | No |

| Montana | no tax | No |

| Nebraska | $0.05/ml | No |

| Nevada | 30% | Ja |

| New Hampshire | 8% | No |

| New Jersey | 10% | No |

| New Mexico | 12.50% | Ja |

| New York | 20% | Ja |

| North Carolina | $0.05/ml | No |

| Nord Dakota | no tax | No |

| Ohio | $0.10/ml | No |

| Oklahoma | no tax | No |

| Oregon | 65% | Ja |

| Pennsylvania | 40% | Ja |

| Rhode Island | no tax | No |

| South Carolina | no tax | No |

| South Dakota | no tax | No |

| Tennessee | no tax | No |

| Texas | no tax | No |

| Utah | 56% | Ja |

| Vermont | 92% | Ja |

| Virginia | $0.11/ml | No |

| Washington | $0.09/ml | Ja |

| West Virginia | $0.075/ml | Ja |

| Wisconsin | $0.05/ml | Ja |

| Wyoming | 15% | No |

(Data Source: Tax Foundation: https://taxfoundation.org/data/all/state/vaping-taxes-2024/, CDC: https://www.cdc.gov/statesystem/factsheets/ecigarette/ECigTax.html)

Ad Valorem Taxes

These taxes are levied as a percentage of either the wholesale or retail price:

- Minnesota: Highest wholesale tax at 95%.

- Vermont: Retail tax rate of 92%.

Specific Tax (Ad Quantum)

These are unit-based taxes, often calculated per milliliter or cartridge:

- Connecticut: Highest closed-system e-cigarette tax at $0.40 per milliliter.

- Delaware and Kansas: Lower rates at $0.05 per milliliter.

High taxes might stop consumers from switching to E-Zigaretten. Many people see these products as a safer choice than regular cigarettes.

Tax Policies and Industry Impact

Excessive taxation can drive consumers back to traditional cigarettes or into black markets, undermining public health goals. For instance, Minnesota’s 95% tax rate prevented over 32,400 smokers from switching to e-cigarettes. Balancing tax policies to promote harm reduction while ensuring adequate revenue generation is critical.

WooVending’s Role in Compliance and Strategy

WooVending is a leader in the e-cigarette industry. We help retailers deal with complex taxes und Vorschriften. We support the development of strategies that include:

- Balanced Tax Policies: Advocating for lower taxes on reduced-risk products to incentivize healthier choices.

- Consumer Education: Offering transparent information on how tax policies affect pricing and product selection.

- Regulatory Updates: Providing up-to-date guidance on legal changes and best practices.

Conclusion: Shaping a Responsible and Compliant Industry

WooVending recognizes that tax and legal compliance are vital to building a responsible and sustainable e-cigarette industry. We provide expert insights and industry leadership. This helps retailers and consumers find the best solutions in a complex regulatory environment.

As state laws change in 2025, WooVending is your trusted partner. We help you stay updated on the latest policies and industry trends.